by Daryl Roberts

A potentially paradigm-shifting technology has been under development at an R&D firm in NJ called Brilliant Light Power. For people monitoring the situation, the question currently is about the status of commercialization. It is not a publicly held firm, but is in mid-stages of private equity capitalization in the range of $100-120M.

I recently read a book titled “Randall Mills and the Search for Hydrino Energy“, offering a detailed and compelling history of the development of this novel renewable energy technology, authored by an insider, an intern who stayed on to work there for several years (published in 2016, with company data as of end of 2015). In order to provide some context, this article will summarize the concept, breakthrough achievements, compare its levelized costs to other generation technologies, offer a brief review of validation efforts, and touch on personnel and capitalization. I will try to be faithful to information presented in the book and website materials, and will try identify my own cautious opinions in context.

Concept

The technology was developed by Randall Mills, whose special talents manifested while still a graduate student in physics at Harvard, when he made a discovery in 1989 while exploring a foundational question in physics about why an orbiting electron did not radiate away its energy. Quantum mechanics diverged from classical mechanics without ever answering this question. Mills emerged with a revised classical theory that included the proposition that hydrogen’s ground state can in fact be lower than previously thought, that it can have fractional ground states.

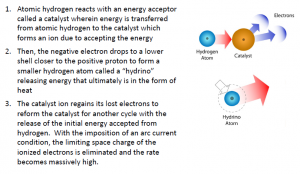

According to Mills’ theory, hydrogen can react with a catalyst in a 2-step process, in which first a small amount of energy is transferred by a process called resonant inductive coupling, in integer increments of 27.2 eV. When this photon is accepted by the catalyst from the atomic hydrogen, the hydrogen electron then becomes unstable and will decay into a lower, fractional orbital, closer to the nucleus. This 2nd step releases a larger increment of energy than would be predicted by any other known chemical reactions, 200x higher than burning hydrogen. The ending species of hydrogen was dubbed a “hydrino”.

Validation

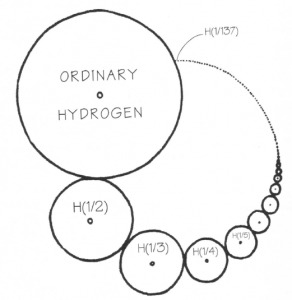

Mills documents extensive experimental confirmation, which to date has identified hydrino states of 1/2, 1/3, 1/4, down to 1/10 (orbital shell distance below 1.0 ground state). The theory calculates possible hydrinos with a theoretical limit of 1/137, constrained by relativistic speeds for the electron travel.

The book documents Mills’ 25-year journey of verification, both with collaborators and validation by a growing number of independent investigators who report finding confirmation in a wide range of experimental configurations. Mills was prolific in publishing his findings in the face of persistent resistance from establishment figures, in progressively more prestigious journals. The reference section of the book documents 96 journal articles with Mills as primary author(as of late 2015, now over 100), 52 journal articles with non-BLP primary authors, and 31 other technical reports regarding hydrino research by various universities, national labs and corporations.

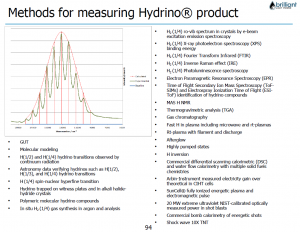

Early lab set ups involved low temperature electrolytic cells, but Mills eventually found that the phenomenon could be triggered and measured more successfully in high temperature plasma conditions. Subsequently, tests were constructed using various types of instrumentation, & validated by leading experimentalists in this field, experts in thermal measurement. A summary of the full extent of the verification data discussed in the book and website materials is beyond the scope of this article. But it’s worth including one slide which shows a list of 29 types of confirming evidence that has been compiled to date, including 7 or 8 types of spectroscopy and 4 or 5 types of calorimetry.

On the website, most of the Validation Reports are compiled under the technology tab and also under the News/ What’s New tab. The focus seems to be weighted most heavily on confirming that the energy is generated by the hydrino reaction process. Business presentations pdf’s, PowerPoints & videos of conference are in the News / Archive tab. The validation page reports 4 independent studies in 2020, 3 in 2019, 5 in 2016, and an additional 17 earlier reports.

Energy Gain

The specific excess heat generated is not documented uniformly within a single reference system. As I searched to compile these results, I found various expressions of “gain” cited in PowerPoint slides reporting outcomes from a range of experiments, as follows:

- “energy gain of 200-500x”

- “Optical energy output of 30x input”

- In a table identifying specific experiments showing a gain column, with 3 cases with highest values showing 399x, 279x & 213x

- “peak power 20MW, time-avg power 4.6MW, optical emission energy 250x applied energy”

- “input power 6.68 kW, output 1,260 kW” 1260/6.68 = 188x

- in terms of power density, as “20MW in microliters”, and elsewhere “billions of watts per liter”

- the 2020 validation studies report finding that hydrino plasma produced excess power of 275kW, 340kW, 200kW & 300kW respectively.

- 2019 report power levels of 1000kW & 100kW.

- 2016 studies report 514kW of optical power & 1.3MW peak power; 689kW with 28x gain; thermal power levels of 440kW; & 1.5MW continuous power from 8.6kW input (1500/8.6 = 174x)

It would benefit the company to clarify and reconcile these value, especially when differing by orders of magnitude, ie., in ranges of 10x vs 100x. This would help to make clear the specific the relationship between these output values and the resulting dramatic reductions in cost of energy production per kW, which are discussed further below.

SunCell

The experimental configurations evolved from demonstrating the effect in single shot events, to systems that could sustain continuous reactions and maintain a stable plasma. These early events in which a target material was bombarded by a catalyst along with a high current, low voltage electrical discharge to create the plasma conditions, resulted in an excess of energy so hot that even electrodes made of tungsten were vaporized.

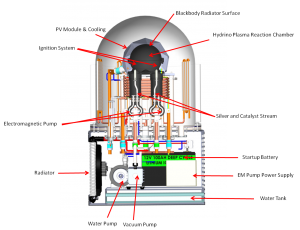

The next steps involved engineering design to develop a commercial prototype, and optimization of supporting systems. The most challenging practical problem was designing an electrode that could withstand the high temperatures. This was solved by making the electrode entirely liquid, an arcing molten metallic silver electrode with a continuous feed, into which the catalyst was mixed, which enabled a continuous plasma reaction. The reaction took place in a small containment vessel, with the two feeder systems, one for the liquid silver, the other for moving the atomic oxygen and hydrogen in and hydrinos out. The plasma is maintained at 4000C and generated very high energy photonic radiation in the Extreme Ultra Violet frequency range (EUV), producing excess heat and molecular signatures confirming Hydrino profiles. Supporting systems were engineered for hydrolysis of the water, for induction pumping the silver, for heat transfer systems, and for electrical offtake.

The system was branded the “SunCell”.

The reaction produces no emissions other than the reduced hydrinos, which are 64x smaller volume than ordinary hydrogen. Current design captures the hydrino gas in a charcoal trap or a milled halide hydroxide crystalline matrix to which the hydrinos can bind. If exhausted into the air, it is inert, non-toxic, lighter than helium and would rise to the upper atmosphere.

The power from the plasma can be utilized either directly as heat with heat exchangers or can be converted to electricity by means of two distinct offtake technology configurations, that were developed and patented:

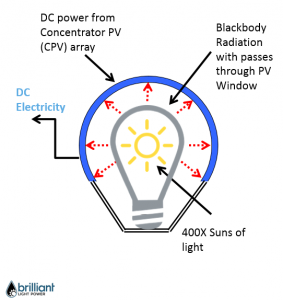

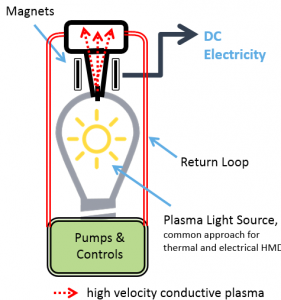

- Concentrating Photovoltaics (CPV) – the EUV can be converted by stepping down the frequency to the visible spectrum by means of “blackbody radiation”. The containment shell is made of refractory materials to optimize this conversion to optical energy which can then be captured with concentrating photovoltaic cells arrayed around the blackbody. The containment sphere is in essence like the filament of a light bulb, capturing multiple suns 24 hours a day, without intermittency.

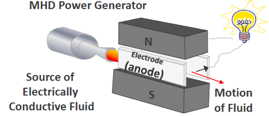

- MagnetoHydroDynamic (MHD) – the plasma heats an expanding gas seeded with conducting silver nanoparticles is passed through a transverse magnetic field, converting kinetic energy to electricity.

The more detailed engineering diagram of the SunCell PV design gives a better sense of the relatively compact scale of the device, in this instance only about 3ft high from the base platform.

The device has very high power densities, can produce continuous power at 20MW/ liter. Below is a working demonstrator prototype in 2016.

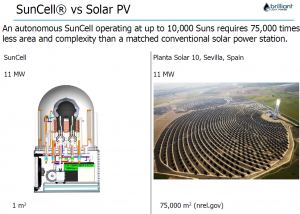

To illustrate the comparative power density of the SunCell compared to other stationary concentrating solar applications, they show this slide:

To illustrate the comparative power density of the SunCell compared to other stationary concentrating solar applications, they show this slide: Costs

Costs

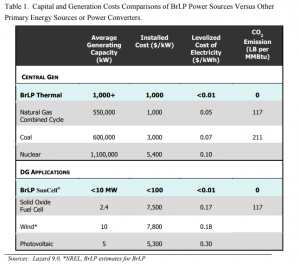

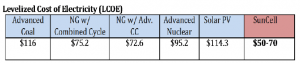

Costs are low because the capital costs to construct the devices are low, one estimate was $60/kW, which is less than 2% of capital costs for solar. Other operating costs are negligible, for maintenance & fuel, because other than the hydrogen fuel, which is derived from water, all the other materials, recycle within the device, and with few if any moving parts, and so can be expected to have life cycles of 20 years or more. The resulting energy costs are estimated at $.01/kWh, substantially lower than any other source. In business presentations from 2016, BLP made an attempt to provide more conservative comparisons using the Levelized Cost of Energy tables provided annually from asset manager considered to be the most reliable & comprehensive surveys are available. Using the most recent report published 11/7/19, BKP places their LCOE in this context, projecting costs at approximately 50% below the cost of solar & 30% less than Gas Combined Cycle.

In business presentations from 2016, BLP made an attempt to provide more conservative comparisons using the Levelized Cost of Energy tables provided annually from asset manager considered to be the most reliable & comprehensive surveys are available. Using the most recent report published 11/7/19, BKP places their LCOE in this context, projecting costs at approximately 50% below the cost of solar & 30% less than Gas Combined Cycle.

With such low operating & capital costs, the revenue model is based on a flat per diem energy lease transaction rather than a metered price per kWh. Revenue is modeled based on a “breakthrough rate” below $.05/kWh, which is an arbitrary price sufficiently below market prices of competing sources, but with an enormous built in margin. Most of the pricing would be based on off-grid provisioning, rather than through the wholesale market auctions through ISOs and other grid operators. Hence, the capex & operating costs would represent approximately only 2-5%, with net earnings above 90%.

Costs will improve at scale, as the largest costs are for the CPV components. At production rates of 10GW annually, the estimated costs of the CPV cells are $32 per kW at concentration of 2000 Suns. A cost analysis for parts for a production model of the 2000 suns version show the PV cell assembly constitutes 60%, or $15,000 out of the total of $25,000. But at higher temperature plasmas, at 10,000 Suns concentration, optimizing output efficiencies, CPV costs drop to less than $6 per kW, or $2800, down to 23%.

Status of Commercialization

If the experimental validation data is accepted, and the resulting production cost calculations are supportable, the pressing question is: what is the status of commercialization? Why are we not seeing some of these devices appearing in the market yet? What is holding up the show? The book doesn’t get into this issue, although the author has communicated his intent to update with a 2nd edition that explains how this next phase has evolved since 2016.

The website unfortunately does not provide an easily accessible section featuring a sequential history of the commercialization status, either in a front page or a top line item in a dropdown menu, or a side bar or a featured story. However, digging deeper, comparing earlier & later website materials, the narrative can be reconstructed. The two main sources are Business Plan pdfs, & Demonstration Days, found under different tabs.

Business Plan pdf’s:

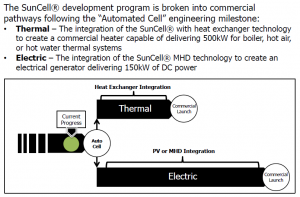

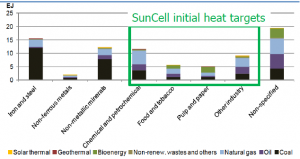

Earlier commercialization plans indicate the first target market will be industrial thermal energy users. The SunCell operates 3x more efficiently & 2.5x lower costs if the end product is process heat only, and the electric conversion phase of the system is not included. BLP envisioned the rollout timeline as shown below, as of 6/14/19.  In Phase 1, after industrial users, commercial & residential thermal users are targeted next. Heat for high GHG generators, steel & concrete are targeted later presumably because those industries are more resistant to change.

In Phase 1, after industrial users, commercial & residential thermal users are targeted next. Heat for high GHG generators, steel & concrete are targeted later presumably because those industries are more resistant to change.

Phase 2 targets electricity markets, initially with the SunCell Photovoltaic design scaled to 10kW – 150kW. The next target would be scaled to 250kW – 2MW, to address Distributed Energy Resources (DERs) for industrial, commercial and multi-tenant residential buildings, providing micro-grid power that can be “islanded” from grid connection, simplifying system designs to eliminate the need for battery storage systems, and eliminating the utility connection costs & queueing time delays. SunCells can operate continuously, but can also be taken off line without curtailment or the need to redirect current to storage. They can be simply shutting down with smart controls to smooth peaking and manage very short ramping & re-start times. Multiple SunCells can be networked with low voltage private grid interconnections, minimizing the need to even interface with the public grid, reducing complications associated with utility permitting. Further, the potential for micro-grid configurations in rural applications could offer solutions to the wildfire risks in California.

Phase 2 targets electricity markets, initially with the SunCell Photovoltaic design scaled to 10kW – 150kW. The next target would be scaled to 250kW – 2MW, to address Distributed Energy Resources (DERs) for industrial, commercial and multi-tenant residential buildings, providing micro-grid power that can be “islanded” from grid connection, simplifying system designs to eliminate the need for battery storage systems, and eliminating the utility connection costs & queueing time delays. SunCells can operate continuously, but can also be taken off line without curtailment or the need to redirect current to storage. They can be simply shutting down with smart controls to smooth peaking and manage very short ramping & re-start times. Multiple SunCells can be networked with low voltage private grid interconnections, minimizing the need to even interface with the public grid, reducing complications associated with utility permitting. Further, the potential for micro-grid configurations in rural applications could offer solutions to the wildfire risks in California.

Phase 3 addresses transportation applications in a subsequent phase, for trains, large-scale marine (transport ships that currently burn high emission bunker oil), buses & trucks, and ultimately passenger vehicles and electric aviation. The MHD version can be scaled down for light vehicles to a size much smaller than either internal combustion engines or EV batteries.

Demonstration Days, found under the News/Archive tab, includes 6 videos of roadshow presentations, with slides, from 1/28/14 – 10/26/16, and 4 additional presentations actually called “Roadshows” (although it is not clear that any of the roadshows are intended to be investor pitches).

Information most relevant to the status of commercialization were a) presentations by two contracted engineering firms, and b) reference in one of the last Demo Day pdfs to a new set of contractors.

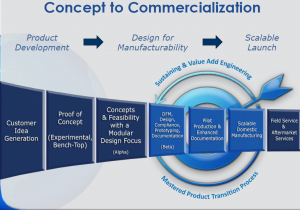

- Columbia Tech which is a mid-sized management firm in Boston, not a GE or Siemens, but does $200M/yr revenues, has 500 employees, was selected by BLP to manage transitional processes moving from the development engineering being done at BLP to the production engineering which may be further farmed out. They presented slides indicating where it thinks BLP is in the process.

This is a nice schematic infographic, but there was little in the content of the presenter’s material that disclosed that CT had actually started doing any work, or that there was an expected date for BLP to begin handing off tasks for CT to execute on its path to production development. Later in that same Demo Day, the in-house marketing director showed his own similar schematic, which added some detail but no new information about actual developments.

- Masimo (formerly Spire, a PV manufacturer) contracted to develop a custom CPV system. However, Masimo also has disappeared, no further reference to either progress on their assigned contract, or that they are even still an industrial partner. Instead, in some later pdf slides, there is indication in some indication that BLP has reconsidered using non-concentrating PV, that they have been making a closer cost benefit analysis.

In the last roadshow pdf 9/12/17, slides #42 – #47 indicated new progress:

- TMI Climate Solutions (subsidiary of MiTek, a Berkshire-Hathaway company) appears to have been engaged to develop designs for boilers to offtake heat for thermal applications;

- Re Columbia Tech, they announce: “SunCell Commercialization engineering is mature enough to be outsourced to CT. Equipment is being fabricated, procured, shipped”. It seems to be associated with updated injector design solutions. Despite this promising indication, there was no further updates about CT after this report.

- PV development progress: indicates changes in design parameters, & perhaps a change from Masimo to SpectroLab (a Boeing company) to complete the development of the triple junction concentrator cells.

6/14/19 is the most recent update in a Business Presentation pdf. However, the material merely refined prior messaging, with some updates of prototyping and engineering solutions of SunCell system components, some new validation experiments conducted by independent scientists, and another review of 17 out of the 29 methods for verification of the Hydrino explanation. However, there were no further updates from ColumbiaTech, Spectrolab or Masimo, TMI Climate Solutions, or any other development partner about component status or overall system fabrication design status.

Advisory Board: Most have relevant experience in renewable energy development, seem to be well chosen to facilitate the development goals, and some have very high level backgrounds, such as James Woolsey, former Director of the CIA. This is at least a hopeful indicator that people with both management talent and influence consider the technology to have potential, & whose presence would tend to exert pressure for development progress.

$100 -120m of investment capital is mentioned in scattered references, all of which is from private equity offerings, but investors are NOT disclosed anywhere in the website. In another reference, there was an indication that some of the other investors were utilities, including a rural electric coop in NM, which may have participated by placing pre-orders rather than taking equity.

The Wikipedia page, which is very one-sided & antagonistic, states: “…Investors include PacifiCorp, Conectiv, retired executives from Morgan Stanley[12] and several former BLP board members:

- Shelby Brewer who was the top nuclear official for the Reagan Administration and CEO of ABB-Combustion Engineering Nuclear Power[17][18] ,

- Michael H. Jordan(1936 – 2010), CEO of PepsiCo , Westinghouse Electric Corporation, CBS Corporation and Electronic Data Systems.[17]”.

Conclusion

With so much potential for triggering transformation with a technology that leaps forward in efficiency & costs and significantly reduces GHG emissions both in fabrication and operation, one can only hope that Brilliant Light Power will be able to accelerate their commercial development process, and upgrade their website to be able to make updates more transparent and accessible.